Welcome to the Spring 2016 edition of The Intelligent Dentist, giving you an insight into buying selling dental practices and improving your own.

In this edition we look at some of the Larger Corporate Groups and provide you with information on emerging new groups.

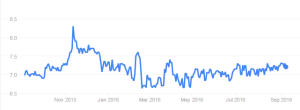

Under the stewardship of Darryl Holmes, ASX listed 1300 Smiles (ONT) share price reached an intraday peak of $8.47 late last year and has now consolidated to just above the $7 mark. ONT recently posted satisfactory results and an increase in profit to $7.6M after tax on flat revenue, mainly through cost cutting measures. They continue to seek larger, more profitable practices which is likely to see their acquisition numbers lower over the next 12 months.

Pacific Smiles (PSQ) posted a $10.2M profit after tax for 2016 on increased revenue and after seeing their share price drop to $1.68 earlier on this year, are seeing a gentle recovery back to $2.36. Again, further acquisitions have been slow for this now mature group, as they become more risk averse and have shareholders to satisfy.

Pacific Smiles (PSQ) posted a $10.2M profit after tax for 2016 on increased revenue and after seeing their share price drop to $1.68 earlier on this year, are seeing a gentle recovery back to $2.36. Again, further acquisitions have been slow for this now mature group, as they become more risk averse and have shareholders to satisfy.

National Dental Care is a large private equity group with practices in every state. They have recently acquired DB Dental and its’ 17 practices across WA earlier this year, Privately held NDC have unsurprisingly shut the door temporarily on aggressively acquiring new practices, having taken their portfolio to 60 Australia wide. They do not currently have an active acquisition team and have also seen many of their earlier sellers come to the end of their very attractive earnout periods from a couple of years ago. We are closely watching this group as they subtly seek larger, multi practice, businesses.

National Dental Care is a large private equity group with practices in every state. They have recently acquired DB Dental and its’ 17 practices across WA earlier this year, Privately held NDC have unsurprisingly shut the door temporarily on aggressively acquiring new practices, having taken their portfolio to 60 Australia wide. They do not currently have an active acquisition team and have also seen many of their earlier sellers come to the end of their very attractive earnout periods from a couple of years ago. We are closely watching this group as they subtly seek larger, multi practice, businesses.

Emerging Groups

There has been much speculation and rumour with regard to the newly formed Strategic Equity Alliance and Aus Dental Group. Share market listing talk has subsided and any IPO will most unlikely happen before the end of this year. We continue to monitor their progress, as we do several other groups, who continue to remain in our recommendations, due to their propensity for risk, leading to higher prices paid with lower earnouts and time periods for our clients.

Recent Sales – 2016

Melbourne Practice – SOLD $1.85M

(Revenue $1.8m, EBIT $350K, earnout 2 years)

Sydney Practice – SOLD $1.8M

Revenue $1.76m, EBIT $30K, earnout 2 years)

Victoria Practice – SOLD $1.73M

(Revenue $1.68, EBIT $315K, earnout 2 years)

Would you like to know the potential sale price of your practice?